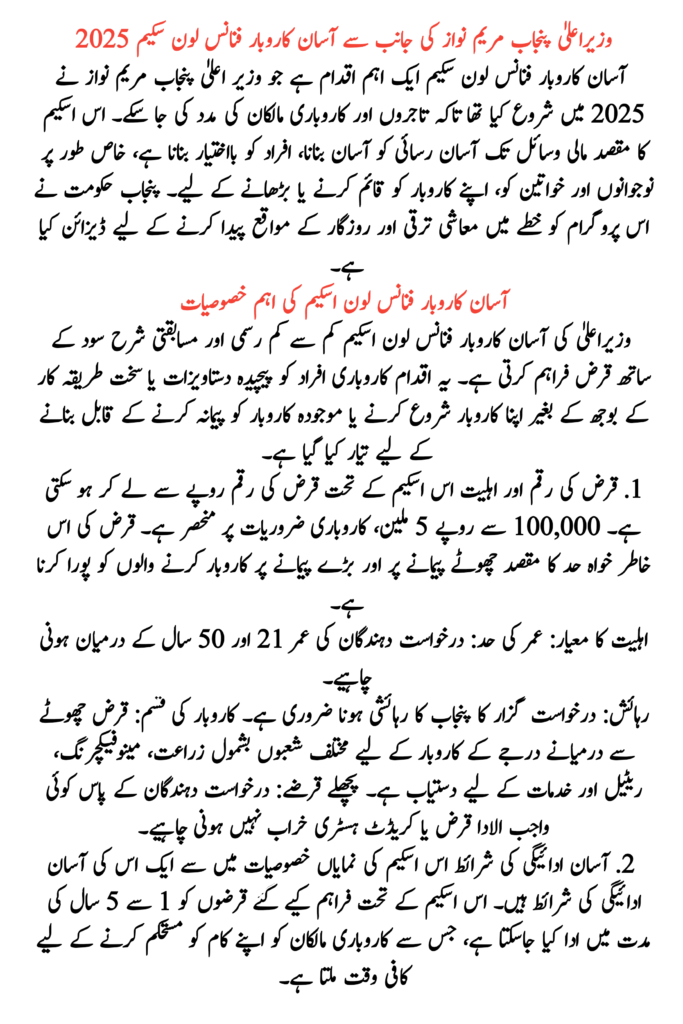

The Asaan Karobar Finance Loan Scheme has been a significant initiative launched by the Chief Minister of Punjab, Maryam Nawaz, in 2025 to support entrepreneurs and business owners. This scheme aims to facilitate easy access to financial resources, empowering individuals, particularly the youth and women, to establish or expand their businesses. The Punjab government has designed this program to foster economic growth and create job opportunities within the region.

Loan Scheme Overview

| Feature | Details |

| Loan Amount | Rs. 100,000 to Rs. 5 million |

| Eligibility Age | 21 to 50 years |

| Loan Tenure | 1 to 5 years |

| Interest Rate | Competitive, lower than traditional banks |

| Collateral | Not required |

| Target Audience | Entrepreneurs, youth, women, small-medium businesses |

| Application Process | Online registration via official portal |

Key Features of the Asaan Karobar Finance Loan Scheme

The Asaan Karobar Finance Loan Scheme by CM provides loans with minimal formalities and competitive interest rates. This initiative is tailored to enable entrepreneurs to start their businesses or scale existing ones without the burden of complicated documentation or rigid procedures.

Read More: Negahban Program Ramadan Relief Package

1. Loan Amount and Eligibility

- The loan amount under this scheme can range from Rs. 100,000 to Rs. 5 million, depending on the business requirements. This substantial loan range is aimed at catering to both small-scale and large-scale entrepreneurs.

Eligibility Criteria:

- Age Limit: Applicants must be between 21 and 50 years.

- Residency: The applicant must be a resident of Punjab.

- Business Type: The loan is available for small to medium-sized businesses across various sectors, including agriculture, manufacturing, retail, and services.

- Previous Loans: Applicants must not have any overdue loans or a poor credit history.

2. Easy Repayment Terms

- One of the standout features of this scheme is its easy repayment terms. The loans provided under this scheme can be repaid over a period of 1 to 5 years, allowing business owners ample time to stabilize their operations. The scheme offers lower interest rates, ensuring that loan repayment doesn’t become a financial burden on small and medium enterprises.

Read More: Benazir Kafalat Program Disqualifications Reason

3. No Collateral Requirement

- Unlike traditional loan schemes, the Asaan Karobar Finance Loan does not require any collateral. This makes the scheme particularly attractive for first-time entrepreneurs who may not have assets to pledge as security. This ensures a fair opportunity for all individuals to access capital for their businesses, regardless of their financial background.

Benefits of the Asaan Karobar Finance Loan Scheme by CM

1. Fostering Entrepreneurship

- By providing access to capital, this scheme helps foster entrepreneurship in Punjab. Young professionals, women, and people from underprivileged backgrounds can now easily set up businesses without facing financial constraints. This leads to increased job creation, particularly in rural areas where employment opportunities may be limited.

2. Boosting Economic Growth

- With more businesses emerging and existing businesses scaling up, the Asaan Karobar Finance Loan Scheme is poised to stimulate economic growth in the region. More businesses mean more products and services, leading to a thriving economy.

Read More: Benazir Taleemi Wazaif 2025

3. Support for Women Entrepreneurs

- A significant portion of the loans under this scheme is reserved for women entrepreneurs. This special focus helps empower women, encouraging them to start their businesses and become financially independent.

4. Government Support

- The Punjab government provides comprehensive support, including training programs and business development services, to help applicants utilize the loans effectively. This guidance ensures that business owners not only have the funds they need but also the expertise to run their operations efficiently.

How to Apply for the Asaan Karobar Finance Loan Scheme

1. Online Registration

- To make the application process easier, the Punjab government has introduced an online registration portal. Applicants can visit the official website to fill out the required forms and submit their applications. The process is designed to be user-friendly and quick, ensuring that no unnecessary delays hinder the applicants.

2. Document Submission

Required documents include:

- CNIC (Computerized National Identity Card)

- Business Plan (for new businesses)

- Tax Registration (if applicable)

- Proof of Residence

3. Approval and Loan Disbursement

- Once the application is reviewed and approved, the loan is disbursed directly into the applicant’s account, allowing them to begin using the funds for their business needs.

Conclusion

The Asaan Karobar Finance Loan Scheme by CM Punjab Maryam Nawaz 2025 is a revolutionary step toward empowering local entrepreneurs and boosting economic development in Punjab. With its easy application process, attractive loan terms, and no collateral requirement, this scheme is set to transform the business landscape of the region. By providing financial assistance to those who need it most, this initiative is helping to create a vibrant, self-sustaining business ecosystem. Entrepreneurs across Punjab now have a genuine opportunity to realize their dreams and contribute to the region’s prosperity.